Introduction

The Turkish economy started to integrate into the international economic and financial system in the early 1980s. Following the full capital account liberalization and currency convertibility decision in 1989, several premature and rapid financial liberalization decisions were reflected in a Turkish economy dependent on foreign capital flows, with unsustainable budget deficits, and very high public sector borrowing requirements. Combined with extraordinarily high inflation and interest rates, lack of proper regulation in the financial sector, and instability in the political system, the 1990s and early 2000s were characterized by economic and financial crises in Turkey. Assuming office in late 2002, the AK Party governments have prioritized macroeconomic and financial stability with fiscal discipline by assuming a largely regulatory function in the financial system, especially the banking sector. Nevertheless, regulatory practices in the financial system do not rule out deregulatory practices in different respects.1 While the IMF program, after the twin economic and financial crises in 2000 and 2001, built the foundations of the transformation of the Turkish economy, it would be an exaggeration to argue that the AK Party simply followed the IMF program after 2002. Successive AK Party governments have transformed the Turkish economy so that Turkey is not a crisis-prone country anymore, despite significant internal and external shocks to the economy. On the other hand, several challenges remain to achieve higher income levels for Turkish citizens, and to accomplish sustainable economic and social development in Turkey.

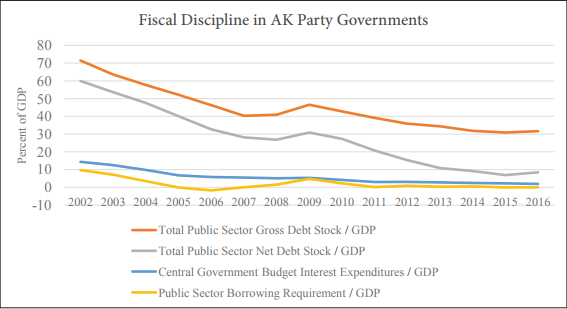

With the help of fiscal consolidation, reforms in the public sector, privatization activities, and declining inflation and interest rates, the AK Party maintained fiscal discipline throughout its tenure

This paper provides a political economy examination of the AK Party governments, with a focus on the macroeconomic policy framework between 2002 and late 2016. It outlines how the priorities of the AK Party governments have changed from those of a regulatory to a more developmental state during this period. The paper is organized as follows: the first section outlines key developments in the emergence of a regulatory state with fiscal discipline in Turkey. The second section underlines the main challenges ahead for the Turkish economy, and the third section discusses whether Turkey is on the verge of becoming a developmental state. The fourth section concludes with a discussion.

The Emergence of a Regulatory State with Fiscal Discipline

The twin crises of 2000 and 2001 constitute a critical juncture for the transformation of the Turkish economy. In order to avoid future bank failures and achieve sustainable public finances and single digit inflation rates, the IMF program after the twin crises prioritized the regulatory function of the state in the financial sector. With this program, Turkey’s Banking Regulation and Supervision Agency (BRSA) became a functional and effective entity, the Central Bank of the Republic of Turkey (CBRT) gained legal independence so that the central bank could not finance budget deficits, and price stability became the primary objective of the central bank. Thus, Turkey’s legal framework ensured that BRSA is responsible for banking regulation and supervision, CBRT is solely responsible for monetary policy, and the Turkish Treasury is responsible for debt management and sovereign borrowing.

During the early years of AK Party rule, lowering inflation to single digits, achieving sustainable public debt, and maintaining a regulatory function in the finance sector were the main objectives. With the goal of achieving fiscal discipline, the AK Party engaged in fiscal consolidation policies, and there was a considerable increase in privatization. For instance, while Turkey completed the 4.6 billion USD equivalent of privatization between 1985 and 1997, privatization implementations reached 8.2 billion USD in 2005 and 8.1 billion USD in 2006.2 Moreover, in 2006 the AK party initiated a social security reform in order to meet three objectives: establishing a single social security system combining divergent practices in social security rights, equalizing health coverage for every citizen with a general health insurance system, and forming an overarching social assistance system which coordinates means-tested social assistance for all citizens.3 With these reforms, the average pension contribution period increased from 7000 to 9000 days, and the minimum official retirement age increased for both males and females. Thus, social security reform was a critical step toward achieving sustainable levels of public debt.

With the help of fiscal consolidation, reforms in the public sector, privatization activities, and declining inflation and interest rates, the AK Party maintained fiscal discipline throughout its tenure. Therefore, public sector borrowing requirements (PSBR), interest expenditures by the central government, and public sector debt stock declined significantly (Graph 1). In establishing fiscal discipline, the leading role of the Turkish Treasury and its coordination with CBRT and other regulatory agencies should be underlined.4

Graph 1: Fiscal Discipline in AK Party Governments

Source: Ministry of Development and Turkish Treasury

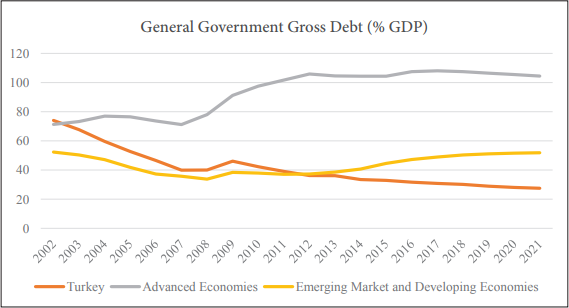

With the help of the fiscal space provided by fiscal discipline, AK Party governments could undertake historical mega projects and use public resources for public services. Comparing the Turkish case with other country groups illustrates the low rates of government debt achieved in Turkey since 2002 (Graph 2). It is critical to underline that Turkey maintained fiscal discipline even after the global financial crisis (GFC) when other countries significantly increased their debt levels. Turkey is expected to maintain low government debt levels until 2021.

Ending the IMF program in Turkey was an important development in terms of enabling Turkey to improve its state capacity and policy autonomy without external interference

Graph 2: General Government Gross Debt

Source: IMF

In addition to these developments in fiscal policy, Turkey started to improve its trading ties with neighboring countries during AK Party rule, and the term “trading state” began to be used to explain active Turkish foreign policy.5 By improving trading ties with other countries, the share of Turkey’s exports to the European Union decreased from 56.3 percent in 2006 to 48 percent in 2016; for Near and Middle Eastern countries, the share of Turkish exports increased from 13.2 percent in 2006 to 22 percent in 2016; and for North Africa and other African countries, Turkey’s share of exports increased from 5.3 percent in 2006 to 8 percent in 2016.6 Furthermore, Turkey has signed free trade agreements with approximately 20 countries since 2003.7

A solar power plant established by an entrepreneur in Yarbaşı, a village in the Adıyaman province of South East Turkey, will produce a thousand kilowatts of electricity daily. | AA PHOTO / EMİN TEZERDİ

In addition to fiscal discipline and active trading activities, other important steps in the early years of AK Party governance include the removal of six zeros from the Turkish lira in 2005, and the lowering of inflation to single digits. These steps were critical in improving the credibility of the Turkish lira in international markets. Other important developments during AK Party rule were to end the IMF program in 2008, and to pay back all debt owed to the IMF by 2013. While the AK Party signed a three-year stand-by agreement with the IMF in 2005, in 2008 this program was not renewed, and by 2013 Turkey had repaid all its debt to the IMF. In total, Turkey has paid off the equivalent of a 23.5 billion dollar debt to the IMF since 2002.8 Previous research illustrates that the IMF programs and policy conditionality attached to these programs weaken state capacity and policy autonomy significantly.9 Thus, ending the IMF program in Turkey was an important development in terms of enabling Turkey to improve its state capacity and policy autonomy without external interference.

Fiscal discipline, improving the credibility of the Turkish lira, and the emergence of independent and functional regulatory agencies in the financial system have led scholars to assert that Turkey is becoming a regulatory state under AK Party rule.10Thanks to the strong macroeconomic foundations of the Turkish economy and the regulatory state, there was no bank failure or crisis in Turkey emanating from the GFC. In addition, the Turkish economy was characterized by high economic growth rates until the negative effects of the GFC began to be experienced throughout the world beginning from late 2008. Correspondingly, under AK Party governments, the Turkish economy suffered an economic slowdown only due to the negative influence of the GFC in 2009.11 Furthermore, the Turkish economy overcame several internal and external shocks without major economic problems in the aftermath of the GFC.12 Despite these achievements, AK Party officials have started to pursue a more developmentalist discourse in the last few years. This is due to the several challenges that lie ahead for the Turkish economy, such as lower-than-expected economic growth, and high unemployment, inflation and interest rates.13 The next section outlines these challenges.

Overall Economy: Gross Domestic Product (GDP) and Manufacturing Indicators

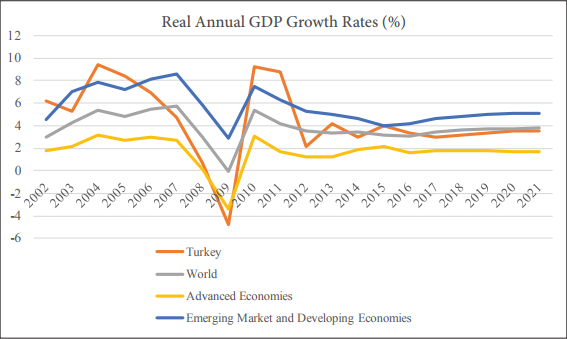

After the economic slow-down of 2009, economic growth started to reach lower than expected rates in 2012. Since 2010, Turkish economic growth rates have remained higher than those of advanced economies but lower than the average growth rate of emerging economies (Graph 3). IMF projections expect Turkey to grow at the moderate rate of around 3 percent until 2021.

Graph 3: Real GDP Growth Rates

Source: IMF

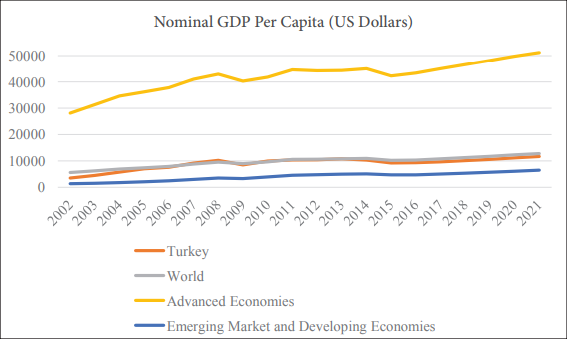

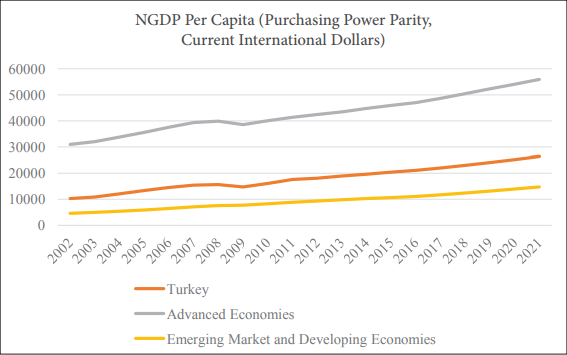

Relatedly, nominal GDP per capita levels have stalled in the last few years (Graph 4) and growth in GDP per capita calculated with purchasing power parity has started to slow down (Graph 5).14 In order to understand the dynamics behind this slowdown, we need to take a closer look at the components of the GDP, and the economic activity that generates economic growth.

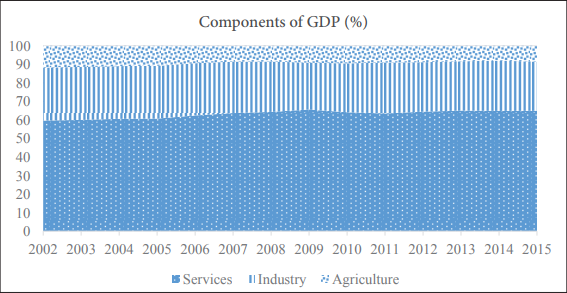

When we look at the main components of GDP in Turkey, the share of agriculture and industry has declined but the share of services has increased since 2002 (Graph 6).

Graph 4: Nominal GDP Per Capita

Source: IMF

Graph 5: GDP Per Capita

Source: IMF

Graph 6: GDP Components

Source: World Bank

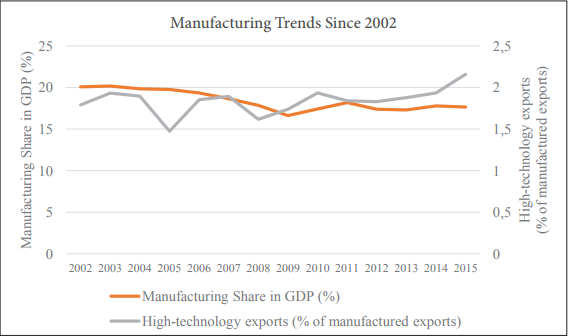

It is important to highlight that industrial activity constitutes an essential element of the economic development of developing countries, and that increase in the service sector combined with decrease in industrial output is the basis of a crucial problem called “premature deindustrialization,” which means that “developing countries are turning into service economies without having gone through a proper experience of industrialization.”15 In other words, industrialization activities have an essential role to play in achieving and sustaining high economic growth rates for developing countries. Relatedly, manufacturing is an essential component of industrialization efforts, and recent studies indicate that the contribution of the manufacturing sector to the GDP in terms of value added and employment has not decreased since the 1970s.16 In other words, manufacturing still matters in achieving development objectives. When we look at the Turkish case, we observe that the share of manufacturing within the GDP has decreased and the share of high-technology exports within manufactured exports has increased minimally since 2002 (Graph 7).

Graph 7: Manufacturing Trends

Source: World Bank

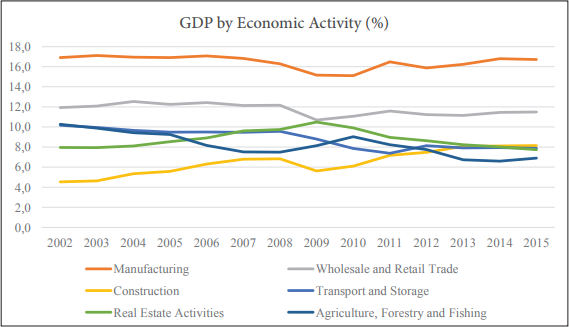

In comparison to the World Bank statistics, TÜİK (Turkish Statistical Institute) also provides data on the economic activities that make up the total GDP in Turkey. A closer look at the TÜİK data on the share of economic activities which in total constitute 60 percent of GDP in Turkey reveals that while the share of manufacturing, trade, and real estate activities remain about the same, the share of construction has increased and the share of transportation and agriculture has decreased since 2002 (Graph 8).

For Turkey, industrial activity, manufacturing and productivity gains constitute one of the major challenges ahead in avoiding the middle-income trap and achieving sustainable economic and social development

Graph 8: GDP by Economic Activity

Source: TÜİK

An import-substitution-industrialization based, protectionist, inward-looking developmentalist perspective shaped the Turkish economy in 1960s and 1970s.17 Since the rise of neoliberal policies in 1980s, development objectives rely on an export-oriented open economy regime.18 Examining the structural changes in the Turkish economy from a historical perspective, Atiyas and Bakış conclude that since the 2000s, the Turkish economy has experienced a significant labor productivity increase, accompanied by a shift from the more traditional exports of garments and textiles to medium-level technology products for motor vehicles and machinery whereas the share of high technology products in exports, as well as the overall export sophistication remains very low compared to counterparts.19 Moreover, the Turkish manufacturing sector relies heavily on imported intermediate inputs and raw materials, and industrial production activities are increasingly shifting to sectors which are more dependent on imported inputs.20 These findings highlight the importance of reexamining industrial and technological policy in Turkey, which have significant potential to improve the quality of industrial production and manufacturing activities. Currently, Turkey enjoys a middle-income level for GDP per capita; the main challenge for Turkey is to avoid the middle-income trap, which occurs when a middle-income country fails to move to higher income levels after a certain threshold, and gets stuck at the middle-income level for a long time.21 One World Bank report indicates that out of 101 middle-income economies in 1960, only 13 escaped the middle-income trap to reach high-income status by 2008.22 For Turkey, industrial activity, manufacturing and productivity gains constitute one of the major challenges ahead in avoiding the middle-income trap and achieving sustainable economic and social development.23

A graphical representation of the new Zigana Tunnel project, under construction on the road between Trabzon and Gümüşhane, part of the Silk Road route connecting the Eastern Black Sea and the Middle East. | AA PHOTO / KARAYOLLARI

A graphical representation of the new Zigana Tunnel project, under construction on the road between Trabzon and Gümüşhane, part of the Silk Road route connecting the Eastern Black Sea and the Middle East. | AA PHOTO / KARAYOLLARI

Structural Problems: Current Account Deficit, Tax Policy, Inflation and Unemployment

Current Account Deficit

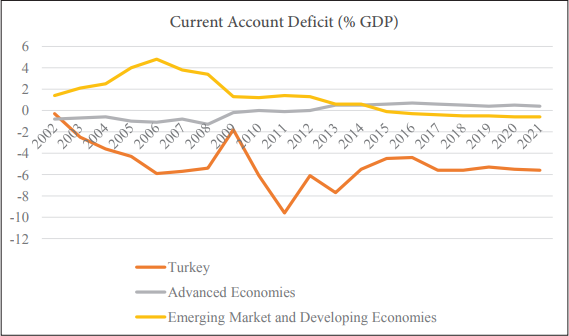

The Turkish economy suffers from the structural problem of current account deficit, which constitutes a major obstacle for the future trajectory of the Turkish political economy (Graph 9). Turkey’s chronic current account deficit is a consequence of several factors: chronic trade deficit resulting from the fact that most of the Turkish export sector is composed of low-technology products, which are not competitive in international markets; Turkey’s industrial production process relies heavily on imported input components; Turkey is an energy dependent country and relies on energy imports.24

Graph 9: Current Account Deficit

Source: IMF

The chronic current account deficit makes the Turkish economy dependent and vulnerable to short-term capital flows, makes Turkish lira very sensitive to the changes in capital inflows and outflows, and constitutes one of the major problems in achieving sustainable economic development in Turkey. Not only for Turkey, but also for other developing countries, current account deficit constitutes one of the main reasons behind their vulnerability to the short-term capital outflows which were the main drivers behind the financial crises.25 The Financial Stability Report of the CBRT published in November 2016 indicates that the decline in Turkey’s current account deficit has started to pause due to geopolitical developments and a decline in tourism revenues.26 The CBRT underlines that Turkey can improve its current account balance in the medium term by increasing its export volumes, presuming the persistence of moderate energy prices.27

The current account deficit is a structural problem for the Turkish economy which can only be addressed with structural measures and a long-term strategy. In other words, cyclical measures cannot resolve this chronic issue. For Turkey to attain a strong and resilient economy, the negative influence of the current account deficit can be avoided by reducing the import components of domestic production, having an internationally competitive, high-technology producing export industry, reducing energy dependence, attracting capital flows which result in long-term investment, employment and technology development. While some policy incentives have been suggested to increase the low savings ratio in Turkey to tackle the negative effects of the current account deficit, it can be argued that without comprehensive tax reforms, achieving the desired savings rates would be very troublesome.

In the following years, policy measures should be implemented to reduce the size of the shadow economy and reform Turkey’s taxation practices

Tax Policy

Although the AK Party governments have been successful in terms of ensuring fiscal discipline in the last 15 years, Turkey’s tax policy did not experience a major overhaul or transformation during this period. Thus, we cannot talk about a comprehensive reform that significantly altered the tax collection practices in Turkey, in contrast to the reforms in debt management, financial regulation and monetary policy. The inability to reform tax collection practices requires a detailed investigation, but for the purposes of this paper several arguments can be made. After the Turkish Treasury was separated from the Ministry of Finance in 1983, the Treasury became the central economic policy-making entity in Turkey, replacing the central role of the Ministry of Finance. Since 1983, the Treasury has been at the center of economic reforms in Turkey. Sidelining the Ministry of Finance resulted in institutional and organizational rigidity so that proactive, innovative measures for tax reform could not be undertaken. In addition, the political nature of tax reforms, the difficulty of replacing the old tax regime with a new one, and the possibility of unintended, unforeseen negative consequences of a tax regime change can be cited as several reasons why there has been no comprehensive tax reform in Turkey to date.

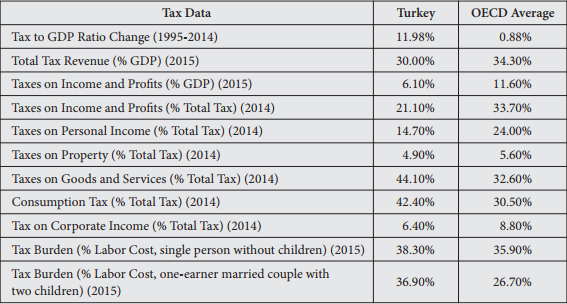

The IMF program after the 2001 crisis included some reforms in the tax system, such as the replacement of several taxes by the single, Special Consumption Tax, changes in personal and corporate income taxes, organizational changes for tax administration, and the establishment of an independent revenue agency that would be responsible for tax collection activities.28 Although the AK Party government rejected the proposal for an independent revenue agency, some of the other proposals were enacted. For instance, corporate income tax was reduced to 20 percent as of 2010 compared to 33 percent in 2001, and personal income tax was reduced to 35 percent as of 2010 from 40 percent in 2001.29 However, these tax changes without an extensive tax reform did not improve the tax collection practices in Turkey. Comparing statistics on taxes in Turkey with OECD countries would give us a better understanding of the tax collection practices in Turkey (Table 1).

Table 1: Comparison of Tax Statistics in Turkey and the OECD Area

Source: OECD Tax Database

Turkey increased the tax to GDP ratio by 12 percent between 1995 and 2014, the highest hike among OECD countries. On the other hand, in Turkey tax revenue constitutes 30 percent of GDP whereas the OECD average is 34 percent. Moreover, in Turkey tax collection relies heavily on taxes on goods and services in the form of indirect taxes; 44 percent of tax revenue come from taxes on goods and services, whereas the OECD average is 33 percent as of the end of 2014. On the other hand, taxes on personal income constitute 15 percent of tax revenue for Turkey and the OECD average for this rate is 24 percent; taxes on corporate income is 6 percent of tax revenue in Turkey and the OECD average is about 9 percent, as of the end of 2014. Lastly, as of 2015, the tax burden in the share of labor cost for a single person without children is 38 percent in Turkey and 37 percent for one-earner married couple with two children whereas these rates are 36 percent and 27 percent in the OECD area, respectively. Related to the tax collection practices is the large share of the shadow economy in Turkey. Recent estimates show that the size of the shadow economy constitutes about 30 percent of the overall economy in Turkey and the OECD average in this respect is about 20 percent.30 The shadow economy represents a non-taxable economy, and 30 percent for Turkey is noteworthy. Tax policy in Turkey has crucial implications for income inequality, savings rates, and social and economic development in general. In the following years, policy measures should be implemented to reduce the size of the shadow economy and reform Turkey’s taxation practices.

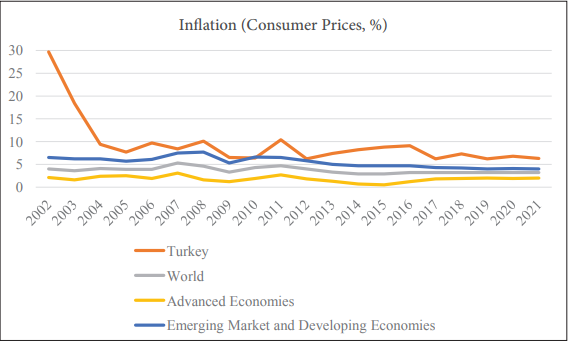

Inflation

The CBRT started implicit inflation targeting in 2001, and inflation targeting became official in 2006. In addition to the price stability objective, since late 2010 the CBRT has actively followed a financial stability objective in line with the changing central banking paradigm, or the “macroprudential turn” in the aftermath of the GFC.31 For financial stability purposes, the CBRT engaged in unconventional policy measures such as an asymmetric interest rate corridor and a reserve option mechanism.32With the help of BRSA’s macroprudential measures, Turkey could control the rapid credit growth rate resulting from the surge of capital flows in the aftermath of the GFC.33 While the CBRT was successful in lowering inflation rates to single digits in the early 2000s, recently there has been a considerable increase in inflation. Consequently, interest rates remain at very high levels compared to world averages. Thus, another challenge ahead for the Turkish economy is dealing with increasing inflation rates, as these rates remain much higher compared to world averages (Graph 10).

Graph 10: Inflation (Consumer Prices)

Source: IMF

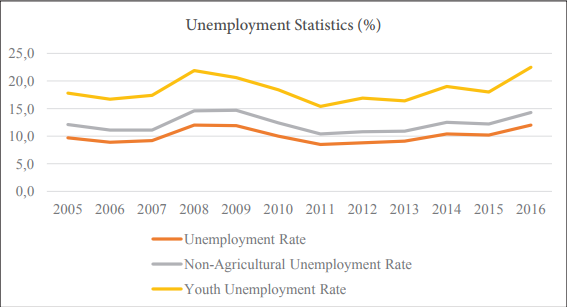

Unemployment and Human Development

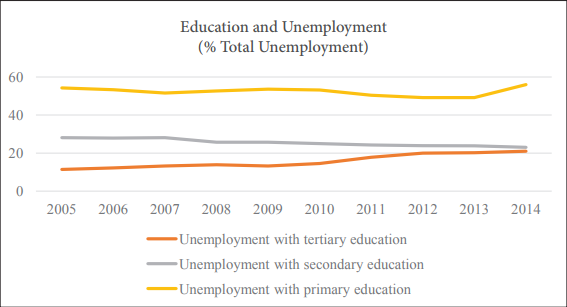

Another important challenge for the Turkish economy is to reduce unemployment levels. As of the end of 2016, overall unemployment reached 12 percent, non-agricultural unemployment increased to 14 percent, and youth unemployment reached a very high level of around 23 percent (Graph 11). These are very high numbers for the Turkish economy and that is the main reason behind President Erdoğan’s call for employment mobilization in February 2017.34 A closer look at the unemployment statistics and their relation to education levels indicate that 56 percent of the unemployed in 2014 have only primary education; the second major group is the unemployed with secondary education at 23 percent (Graph 12). Another worrying trend is that the share of unemployed with postsecondary education has risen rapidly in the last few years, reaching 21 percent in 2014.

Graph 11: Unemployment Statistics (Seasonally Adjusted)

Source: TÜİK

Graph 12: Education and Unemployment

Source: World Bank

These statistics underline that Turkey can improve employment conditions and reduce high unemployment levels not only with economic policy measures and private sector activities but also with education policies. Vocational training, university-industry collaborations and training the labor force for skill development can play important roles in addressing these challenges.

Another area for improvement in addressing Turkey’s development challenges is that of human development. The Human Development Index prepared by the United Nations Development Program (UNDP) ranks Turkey 71st among 188 countries. Turkey is categorized within the “high human development” group of countries, which is one level lower than the group of 51 countries which achieve a “very high human development” level.35 Recent studies indicate that in Turkey between 2003 and 2008, absolute poverty declined rapidly whereas between 2008 and 2012 it decreased marginally, and the change in relative poverty was negligible between 2003 and 2012.36 In terms of income inequality, Turkey has one of the highest levels of GINI coefficient among OECD countries; recent studies suggest that while the GINI coefficient declined to 0.41 in 2007, since then it has been increasing.37 Another study finds that with increasing education levels, income inequality decreases in Turkey.38 Thus, in considering human development and inequality in different respects, education policy has an important function in addition to economic and social policy. This underlines that in achieving development objectives, contributions from different policy areas are essential.

Turkey can improve employment conditions and reduce high unemployment levels not only with economic policy measures and private sector activities but also with education policies

From a Regulatory to a Developmental State?

As articulated in the previous sections, the AK Party has achieved and maintained macroeconomic and financial stability during its tenure, and Turkey is not a crisis-prone country anymore. Nevertheless, lower than desired economic growth, high unemployment, inflation and interest rates have led the AK Party to pursue a more developmentalist discourse in the last few years. Harsh criticisms against the central bank policies and resulting high interest rates,39 a strong emphasis on domestic technology development and production in the defense40 and automobile industry,41 an ambitious long-term industrial strategy plan,42 several subsidy schemes announced for the private sector,43 strong support for President Erdoğan’s call for employment mobilization,44 the recent initiatives of establishing a sovereign wealth fund45 and facilitating citizenship for investors,46 are clear indications of the more active developmentalist mentality of the present AK Party rule. These initiatives raise the question of whether Turkey is becoming a developmental state, and this question requires a brief review of the “developmental state” literature.

TCG Bayraktar, the largest and most technologically advanced domestic and national amphibious tank extradition vessel to be built by the private sector in Turkey, was delivered to the Turkish Navy on April 22, 2017. | AA PHOTO / İSA TERLİ

Despite significant historical, social, political and institutional divergence among the group of developmental states, the key overarching common theme that explains their successful economic development experience is achieving high levels of industrialization and the state’s strategic role in this process by taming domestic and international market forces for national ends.47 Thus, the key for becoming a developmental state is “to find the appropriate mixture of market orientation and government intervention consistent with rapid and efficient industrialization.”48 Despite significant differences in terms of the relationship between the public sector and the private sector, one commonality in developmental states is that there are key public entities, or “pilot agencies” which are responsible for the design of the industrial strategy. In Japan, the Ministry of International Trade and Industry (MITI), in South Korea, the Economic Planning Board (EPB), and in Taiwan, the Industrial Development Bureau (IDB) and Economic Planning Council (EPC) have been such pilot agencies with critical importance to industrial and technological strategy in developmental states. This demonstrates that improving organizational capabilities in critical public entities is essential for achieving industrial and technological objectives.

Wade asserts the importance of coordination mechanisms in the emergence of developmental states and highlights that in many countries different mechanisms with divergent features have been established to achieve pro-development goals. Despite the differences in institutional frameworks for coordination, Wade underlines that these coordination mechanisms should meet four conditions in order to accomplish the developmental goals: public and private sector should be represented in a balance; public officials should have a pro-development mindset with an active public-service orientation; bifurcated political and economic administrative frameworks should be created by the state so that political patronage can be provided through political channels without losing economic efficiency; state officials involved in close relations with the private sector should not have large public resources under their control, and these resources should be in control of a separate entity.49Naturally this is not an easy task and there will be many obstacles to establishing such well-functioning, efficient coordination mechanisms among public organizations and between the public and private sector. Nevertheless, public officials should have the long-term vision to work towards this end. This mindset is well articulated in a quotation from Goethe displayed in the elevator of Taiwan’s IDB: “The most important thing in life is to have a goal, and the determination to achieve it.”50

For Turkey to achieve the status of a developmental state, industrialization should be prioritized as a key economic policy objective

For Turkey to achieve the status of a developmental state, industrialization should be prioritized as a key economic policy objective, investment and capital flows should be directed to industrial manufacturing activities which will enhance technological development, export competitiveness in tradable goods and employment conditions. Here it is critical to underline that industrialization objectives can only be achieved by maintaining macroeconomic and financial stability, not without them. Therefore, a strong and resilient Turkish economy provides a good basis for industrialization efforts in avoiding the middle-income trap. Turkey can avoid the middle-income trap only by means of a targeted industrial policy in strategically important industrial sectors, with the overarching goal of diversifying and upgrading the export composition of the economy and improving the domestic value added.51 Moreover, public entities responsible for industrial and technological strategy should improve their organizational capabilities so that they will be able to play a proactive role in policy formulation, implementation, and evaluation. These entities should also improve their communications with the private sector, especially the real sector. In Turkey, different entities are responsible for different economic activities. For instance, the Ministry of Economy is responsible for foreign trade, the Ministry of Development is responsible for guiding and coordinating Turkey’s macro development objectives, and the Ministry of Science, Industry, and Technology is responsible for industrial policies. For Turkey to realize its industrialization objectives with a comprehensive industrial and technological strategy, close coordination and cooperation mechanisms between not only these entities but other public organizations such as the Treasury, and the ministries of Finance, Education, Energy and Food, Agriculture and Livestock need to be established. Turkey’s industrialization objectives can only be achieved with contributions from different policy areas. A “pilot agency” can be established for these purposes.52

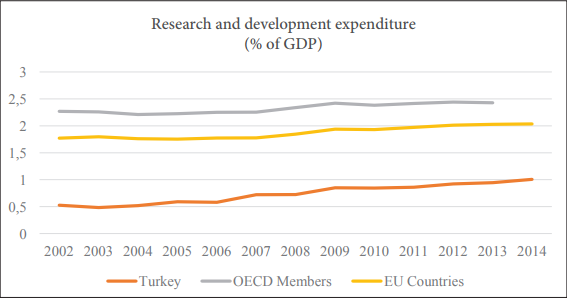

Graph 13: Research and Development Expenditure

Source: World Bank

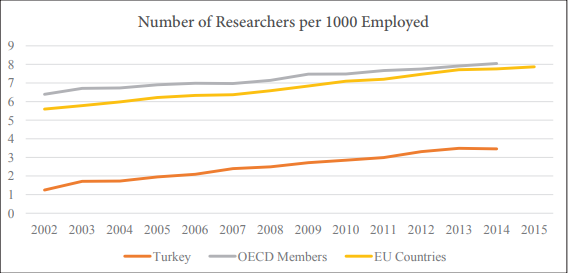

Graph 14: Number of Researchers per 1000 Employed

Source: OECD

Another line of research that investigates the role of the state in achieving economic development objectives is the emerging “innovation policy” or “entrepreneurial state” literature which underlines that states have important roles to play in facilitating innovations in different industries.53 Innovation policies are distinguished between mission-oriented, invention-oriented and system-oriented, such that by utilizing different instruments such as fiscal incentives, direct support, training and technical assistance, states can promote innovative practices in different industrial sectors.54 Therefore, governments can take active roles not just in fixing market failures but also in creating new markets. In this respect, government expenditures on research and development is an important metric. Graph 13 illustrates that compared to OECD and EU member countries, Turkey lags behind in terms of share of government expenditure on research and development in GDP. Moreover, Turkey has a very low number of researchers per 1,000 employed, compared to OECD and EU countries (Graph 14).

It is essential that different policy areas such as industrial, trade, fiscal, monetary, education, and agriculture work in tandem for these objectives by creating a culture of coordination and cooperation in public administration

The initiatives of YÖK (Council of Higher Education) and TÜBİTAK (The Scientific and Technological Research Council of Turkey) in supporting PhD students in different areas is an important step in the right direction for improving research and development activities in Turkey. Nevertheless, just increasing the number of people with PhDs and researchers addresses only one aspect of Turkey’s research and development gap. A second and possibly more important aspect of supporting researchers would be to provide favorable employment conditions in public or private organizations where they can carry out high-quality research. Thus, universities, as well as public and private entities should be given incentives to employ researchers. Furthermore, research outputs should be screened regularly by public authorities to make these incentives meaningful. Public and private organizations which provide a research-friendly environment to their researchers have very important roles to play in closing Turkey’s research and development gap, and the state can play an active role by providing a research friendly institutional framework for employers. Notwithstanding the importance of incentive schemes, the use of public resources for developmental goals and innovation policies should not come at the expense of broader public benefits. In other words, public resources should be utilized so that rent-seeking is avoided, incentives are given and evaluated per pre-determined criteria, public resources are used for public purposes and rewards from innovative practices emanating from public resources are shared with the overall society.

Discussion and Conclusion

This article provides a political economy examination of the AK Party rule in Turkey with a focus on the macroeconomic policy framework. In doing so, this paper articulates that, thanks to the proper regulation and supervision of the financial sector combined with fiscal discipline, Turkey is no longer a crisis-prone country. However, there are challenges ahead for avoiding the middle-income trap and reaching sustainable long-term economic and social development objectives. Lower than desired economic growth rates, high unemployment, inflation, interest rates, structural deficiency in terms of current account deficit and the lack of a comprehensive, long-term industrial and technological strategy emerge as the leading challenges for the Turkish economy.

While the AK Party has revealed that their priorities are evolving to a more developmentalist orientation in the last few years, it is too early to conclude that Turkey is becoming a developmental state. This article argues that to become a developmental state, Turkey should prioritize achieving higher levels of industrialization, and incentives should be given to investments in the manufacturing sector that will improve the export competitiveness of tradable goods in strategically important industrial sectors which will create favorable employment conditions for job seekers. This requires a long-term, comprehensive industrial strategy with contributions from public organizations, the real sector, the financial sector, universities and non-governmental organizations. It is essential that different policy areas such as industrial, trade, fiscal, monetary, education, and agriculture work in tandem for these objectives by creating a culture of coordination and cooperation in public administration. The public sector by itself cannot achieve the desired industrial outcomes. Thus, communications with the real sector, the financial sector, universities, and non-governmental organizations need to be improved. With the latest referendum results and the shift to a presidential system starting in 2019, how the new system will alter the dynamics of achieving development objectives will provide rich ground for future research.

This study is mainly concerned with the domestic dynamics behind the emergence of a developmental state but the influence of the international economic and financial system on Turkish development prospects should not be neglected. Turkey was subject to the significant influence of Washington Consensus policies in the 1980s and 1990s, and Post-Washington consensus policies since the early 2000s. With the evolving international development dynamics, the Turkish economy can take advantage of the emerging Beijing Consensus55 by improving its infrastructure and taking part in the ambitious Chinese initiative of “One Belt One Road.” In addition, Turkey should seek to improve its domestic technology capability in different sectors by facilitating technology transfer from foreign investments. This would require authorities to find innovative means for facilitating technology transfer to Turkish companies. There is no single recipe for achieving these objectives in different contexts. Therefore, learning from other country experiences and translating these lessons to the Turkish context in consideration of social, economic, and political conditions, being flexible in policy formulation and implementation, objectively evaluating policies through time and an overall “learning by doing” strategy would provide the key leads along this long and laborious road.

In Turkey’s quest to achieve economic and social development objectives, researchers have a very important role to play. As Minsky rightly advocated three decades ago, we must go beyond fiscal and monetary policy measures in addressing development challenges.56 That is why researchers should pay more attention to the diverse set of policy areas such as industrial, innovation, education, energy, trade and agriculture, to name a few. In doing so, researchers should seek to provide policy implications of their research so that policy design and evaluation principles can be improved in diverse areas. More specifically, researchers should move beyond questions of what to do, to how to do it:

“Few will argue that full employment, stable prices, and the elimination of poverty are desirable; the difficulty is finding a way to attain these and other equally admirable goals. The time when promises without effective programs will do is past: We must go beyond ‘what’ to ‘how.’”57

I believe that policy recommendations on “how” questions can best be reached by studying distinct policy areas in different country experiences with a detailed case study orientation. Therefore, universities with research orientation and researchers with policy orientation have much to offer to Turkey’s development challenges in the coming years.

Endnotes

- Relatedly, AK Party rule combined neoliberal economic policies with a social policy dimension, resulting in the emergence of “social neoliberalism” as an economic development trajectory. For more on social neoliberalism in Turkey, see Tim Dorlach, “The Prospects of Egalitarian Capitalism in the Global South: Turkish Social Neoliberalism in Comparative Perspective,” Economy and Society, Vol. 44, No. 4 (2015), pp. 519-544.

- Republic of Turkey Prime Ministry Privatization Administration, “Privatization in Turkey,” retrieved March 25, 2017, from http://www.oib.gov.tr/program/uygulamalar/privatization_in_turkey.htm.

- Mehmet Fatih Aysan, “Reforms and Challenges: The Turkish Pension Regime Revisited,” Emerging Markets Finance and Trade, Vol. 49, No. 5 (2013), pp. 148-162.

- M. Coşkun Cangöz and Emre Balibek (Ed.), Treasury Operations In Turkey and Contemporary Sovereign Treasury Management, (U.S.: Lulu Press, Inc., 2014).

- Kemal Kirişçi, “The Transformation of Turkish Foreign Policy: The Rise of the Trading State,” New Perspectives on Turkey, Vol. 40, No. 1 (2009), pp. 29-57.

- Turkish Statistical Institute (TÜİK), “Foreign Trade,” retrieved March 27, 2017, from http://www.turkstat.gov.tr/UstMenu.do?metod=temelist.

- Republic of Turkey Ministry of Economy, “General Information About Free Trade Agreements” (in Turkish), retrieved March 27, 2017, from http://www.ekonomi.gov.tr/portal/faces/home/disIliskiler/SerbestTic?_afrLoop=571300297881629#!%40%40%3F_afrLoop%3D571300297881629%26_adf.ctrl-state%3Di84la1yte_113.

- Republic of Turkey Prime Ministry Office of Public Diplomacy, “Turkey´s Debt to IMF Is Ending,” retrieved April 2, 2017, from http://kdk.gov.tr//en/haber/turkeys-debt-to-imf-is-ending/267.

- An example of IMF’s negative influence on state capacity and policy autonomy is Turkey’s failure to attract important foreign investment by the Hyundai Motor Company in 2005. See Caner Bakır, “Bargaining with Multinationals: Why State Capacity Matters,” New Political Economy, Vol. 20, No. 1 (2015), pp. 63-84.

- Caner Bakır and Ziya Öniş, “The Regulatory State and Turkish Banking Reforms in the Age of Post-Washington Consensus,” Development and Change, Vol. 41, No. 1 (2010), pp. 77-106.

- It is worth remembering that since the end of World War II, the world economy as a whole contracted only in 2009.

- The last and major shock was the coup attempt of July 15, 2016. For more on the political economy of the failed coup attempt, see Sadık Ünay and Şerif Dilek, “July 15: Political Economy of a Foiled Coup,” Insight Turkey, Vol. 18, No. 3 (2016), pp. 235-261.

- For an examination of domestic conditions that lie under the difficulty of transitioning to a new development course in Turkey, see Ali Burak Güven, “Rethinking Development Space in Emerging Countries: Turkey’s Conservative Countermovement,” Development and Change, Vol. 47, No. 5 (2016),

pp. 995-1024. - Figures on nominal GDP per capita and GDP per capita with purchasing power parity are given with the purpose of giving the readers a comparative perspective on different calculations of GDP per capita.

- Dani Rodrik, “Premature Deindustrialization,” Journal of Economic Growth, Vol. 21, No. 1 (2016),

pp. 1-33. - Nobuya Haraguchi, Charles Fang Chin Cheng and Eveline Smeets, “The Importance of Manufacturing in Economic Development: Has this Changed?” World Development, Vol. 93 (2017), pp. 293-315.

- Ziya Öniş, “Crises and Transformations in Turkish Political Economy,” Turkish Policy Quarterly, Vol. 9, (2010), pp. 45-61.

- Öniş, “Crises and Transformations in Turkish Political Economy.”

- İzak Atiyas and Ozan Bakış, “Structural Change and Industrial Policy in Turkey,” Emerging Markets Finance and Trade, Vol. 51, No. 6 (2015), pp. 1209-1229.

- Şeref Saygılı, Cengiz Cihan, Cihan Yalçın, Türknur Hamsici, “Türkiye İmalat Sanayiin İthalat Yapısı,” Türkiye Cumhuriyet Merkez Bankası Çalışma Tebliği, No. 10/02, (2010).

- Fernando Gabriel Im and David Rosenblatt, “Middle-Income Traps: A Conceptual and Empirical Survey,” Journal of International Commerce, Economics and Policy, Vol. 6, No. 3 (2015), p. 1550013.

- World Bank, “China 2030: Building a Modern, Harmonious, and Creative High-Income Society,” (2012), p. 12, retrieved May 26, 2017, from http://documents.worldbank.org/curated/en/781101468239669951/pdf/762990PUB0china0Box374372B00PUBLIC0.pdf.

- Ziya Öniş and Mustafa Kutlay, “Rising Powers in a Changing Global Order: The Political Economy of Turkey in the Age of BRICS,” Third World Quarterly, Vol. 34, No. 8 (2013), pp. 1409-1426.

- Mustafa Kutlay, “The Turkish Economy at a Crossroads: Unpacking Turkey’s Current Account Challenge,” Global Turkey in Europe: Working Paper, No. 10, (2015), retrieved May 26, 2017, from http://www.iai.it/sites/default/files/gte_wp_10.pdf.

- Ziya Öniş, “Varieties and Crises of Neoliberal Globalization: Argentina, Turkey and the IMF,” Third World Quarterly, Vol. 27, No. 2 (2006), pp. 239-263.

- CBRT, “Financial Stability Report - November 2016,” p. 2-3, retrieved April 3, 2017, from http://tcmb.

gov.tr/wps/wcm/connect/TCMB+EN/TCMB+EN/Main+Menu/PUBLICATIONS/Reports/Financial+

Stability+Report/2016/Volume+23/. - CBRT, “Financial Stability Report - November 2016,” p. 3.

- Leyla Ateş, “Domestic Political Legitimacy of Tax Reform in Developing Countries: A Case Study of Turkey,” Wisconsin International Law Journal, Vol. 30, No. 3 (2012), pp. 706-760; İzak Atiyas, “Economic Institutions and Institutional Change in Turkey during the Neoliberal Era,” New Perspectives on Turkey, Vol. 47, (2012), pp. 57-81. Atiyas asserts that one of the reasons the AK Party did not renew the IMF program in 2008 was the proposal of establishing an independent revenue agency for tax collection.

- Nesrin Candan, “Türkiye’de 1990 Yılından Sonra Uygulanan Vergi Politikalariı ve Kriz Etkisi,” Turkish Journal of Agricultural Economics, Vol. 18, No. 2 (2012), pp. 79-86.

- Ceyhun Elgin and Friedrich Schneider, “Shadow Economies in OECD Countries: DGE vs. MIMIC Approaches,” Boğaziçi Journal Review of Social, Economic and Administrative Studies, Vol. 30, No. 1 (2016),

pp. 51-75, doi:10.21773/boun.30.1.3. - Erdem Başçı and Hakan Kara, “Financial Stability and Monetary Policy,” CBRT Working Paper, No: 11/08 (2011); Erdem Başçı, “Monetary Policy of Central Bank of the Republic of Turkey after the Global Financial Crisis,” Insight Turkey, Vol. 14, No. 2 (2012), pp. 23-26.

- Ahmet Faruk Aysan, Salih Fendoğlu and Mustafa Kılınç, “Managing Short-term Capital Flows in New Central Banking: Unconventional Monetary Policy Framework in Turkey,” Eurasian Economic Review, Vol. 4, No. 1 (2014), pp. 45-69.

- The CBRT devotes long sections of its “Financial Stability Report” to household indebtedness and corporate sector foreign exchange loans because these are considered critical financial stability risks for the Turkish economy.

- “Erdoğan’s Employment Mobilization Garners Turkish Businessmen’s Support,” Daily Sabah, (February 14, 2017), retrieved April 5, 2017, from https://ww1`w.dailysabah.com/economy/2017/02/15/erdogans-employment-mobilization-garners-turkish-businessmens-support.

- United Nations Development Program (UNDP), “Human Development Index” (HDI), retrieved April 7, 2017, from http://hdr.undp.org/en/content/human-development-index-hdi. HDI takes into account life expectancy at birth and expected years of schooling in addition to income levels of countries.

- Sirma Demir Șeker and Stephen P. Jenkins, “Poverty Trends in Turkey,” The Journal of Economic Inequality, Vol. 13, No. 3 (2015), pp. 401-424.

- Alpay Filiztekin, “Income Inequality Trends in Turkey,” İktisat İşletme ve Finans, Vol. 30, No. 350 (2015), pp. 63-92.

- Esra Öztürk and Ayşegül Kayaoğlu, “Education and Income Inequality in Turkey: New Evidence from Panel Data Analysis,” Marmara Üniversitesi İktisadi ve İdari Bilimler Dergisi, Vol. 38, No. 2 (2016),

pp. 207-222. - “Turkish Gov’t Piles More Pressure on Central Bank over Interest Rates,” Reuters, (May 28,

2014), retrieved April 2, 2017, from http://uk.reuters.com/article/turkey-economy-rates-idUKL6N0OE24R20140528. - “Turkey’s Defense Exports Rise in First Two Months of 2016,” TRT World, (Mar 11, 2016), retrieved April 2, 2017, from http://www.trtworld.com/turkey/turkeys-defence-exports-rise-in-first-two-months-

of-2016-65562; Carola Hoyos and Antoine Amann, “Turkey Builds Domestic Defense Industry,”

Financial Times, (October 9, 2013), retrieved April 8, 2017, from https://www.ft.com/content/837ef75a-

1980-11e3-afc2-00144feab7de. - Evrin Güvendik, “Turkey’s Domestic Electric Car to Hit the Road in 2019,” Daily Sabah, (April 21, 2016), retrieved April 9, 2017, from https://www.dailysabah.com/automotive/2016/04/21/turkeys-

domestic-electric-car-to-hit-the-road-in-2019. - Ministry of Science, Industry and Technology, “Turkey Industrial Strategy Document” (in Turkish), retrieved May 23, 2017, from http://sanayipolitikalari.sanayi.gov.tr/Public/TurkiyeSanayiStratejisi.

- “Ineffective Subsidies will be Redesigned” (in Turkish), Dünya, (May 26, 2017), retrieved May

27, 2017, from https://www.dunya.com/sektorler/etkisiz-kalan-destekler-yeniden-tasarlanacak-haberi-

364471. - “Foreign Exchange Fluctuations ‘Temporary’ as Dollar-Lira Parity Already Easing: PM Yıldırım,” Hürriyet Daily News, (February 14, 2017), retrieved April 10, 2017, from http://www.hurriyetdailynews.com/foreign-exchange-fluctuations-temporary-as-dollar-lira-parity-already-easing-pm-yildirim.aspx?pageID=238&nID=109744&NewsCatID=345.

- “Here’s What you Should Know about Turkey’s Sovereign Wealth Fund,” Daily Sabah, (February 6, 2017), retrieved April 11, 2017, from https://www.dailysabah.com/economy/2017/02/06/heres-

what-you-should-know-about-turkeys-sovereign-wealth-fund. - Tuba Şahin, “New Turkish Citizenship Rules to Encourage Investment,” Anatolian Agency, (January

12, 2017), retrieved April 11, 2017, from http://aa.com.tr/en/economy/new-turkish-citizenship-rules-

to-encourage-investment/725992. - Ziya Öniş, “The Logic of the Developmental State,” Comparative Politics, Vol. 24, No. 1 (1991), pp. 109-126.

- Öniş, “The Logic of the Developmental State,” p. 110.

- Robert H. Wade, “After the Crisis: Industrial Policy and the Developmental State in Low‐Income Countries,” Global Policy, Vol. 1, No. 2 (2010), pp. 150-161.

- Linda Weiss and Elizabeth Thurbon, “Where There’s a Will There’s a Way: Governing the Market in Times of Uncertainty,” Issues and Studies, Vol. 40, No. 1 (2004), pp. 61-72.

- Robert H. Wade, “Industrial Policy in Response to the Middle‐Income Trap and the Third Wave of the Digital Revolution,” Global Policy, Vol. 7, No. 4 (2016), pp. 469-480.

- Turkey has witnessed an increase in coordination mechanisms between different entities, especially for economic and financial policy objectives. Some examples are the Economy Coordination Board (2009), the Financial Stability Committee (2011) and the Food and Agricultural Product Markets Monitoring and Evaluation Committee (2014).

- Jakob Edler and Jan Fagerberg, “Innovation Policy: What, Why, and How,” Oxford Review of Economic Policy, Vol. 33, No. 1 (2017), pp. 2–23; Mariana Mazzucato, The Entrepreneurial State, (London: Anthem Press, 2013).

- Edler and Fagerberg, “Innovation Policy.”

- Mustafa Yağcı, “A Beijing Consensus in the Making: The Rise of Chinese Initiatives in the International Political Economy and Implications for Developing Countries,” Perceptions: Journal of International Affairs, Vol. 21, No. 2, (2016) pp. 29-56.

- Hyman P. Minsky, Stabilizing an Unstable Economy, (New Haven: Yale University Press, 1986).

- Minsky, Stabilizing an Unstable Economy, p. 319.